MARKET SIZE

FMCG market reached US$ 56.8 billion as of December 2022. Total revenue of FMCG market is expected to grow at a CAGR of 27.9% through 2021 to 2027, reaching nearly US$ 615.87 billion. In 2022, urban segment contributed 65% whereas rural India contributed more than 35% to the overall annual FMCG sales. Good harvest, government spending expected to aid rural demand recovery in FY24. The sector had grown 8.5% in revenues and 2.5% in volumes last fiscal year. In the January-June period of 2022, the sector witnessed value growth of about 8.4% on account of price hikes due to inflationary pressures. In Q2, CY22, the FMCG sector clocked a value growth of 10.9% Y-o-Y — higher than the 6% Y-o-Y value growth seen in Q1.

Indian food processing market size reached US$ 307.2 trillion in 2022 and is expected to reach US$ 547.3 trillion by 2028, exhibiting a growth rate (CAGR) of 9.5% during 2023-2028.

Digital advertising will grow at 14.75% CAGR to reach Rs. 35,809 crore (US$ 4.3 billion) by 2023, with FMCG industry being the biggest contributor at 42% share of the total digital spend.

India includes 780 million internet users, where an average Indian person spends around 7.3 hours per day on their smartphone, one of the highest in the world. Number of active internet users in India will increase to 900 million by 2025 from 622 million in 2020. In 2021, India’s consumer spending was US$ 1,891.90 billion. Indian villages, which contribute more than 35% to overall annual FMCG sales, are crucial for overall revival of the sector. E-commerce now accounts for 17% of the overall FMCG consumption among evolved buyers, who are affluent and make average spends of about Rs. 5,620 (US$ 68).

India’s e-commerce industry recorded a 36.8% year-on-year growth in 2022. Indian e-commerce market is anticipated to reach a value of Rs. 26,459.18 billion (US$ 319.3 trillion) by the end of 2027, expanding at a CAGR of ~26.71% during the 2022 – 2027 period. The market has grown exponentially over the past five years due to the surge in internet and smartphone users, improved policy reforms, and increase in disposable income. Mobile wallets, Internet banking, and debit/credit cards have become popular among customers for making transactions on e-commerce platforms. As of 2021, there were 1.2 million daily e-commerce transactions. The total value of digital transactions stood at US$ 300 billion in 2021 and is projected to reach US$ 1 trillion by 2026.

The India online grocery market size has been projected to grow from US$ 4,540 million in 2022 to US$ 76,761.0 million by 2032, at a CAGR of 32.7% through 2032.

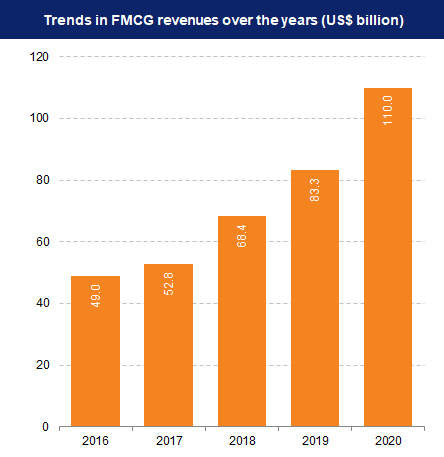

The retail market in India is estimated to reach US$ 1.1 trillion by 2020 from US$ 840 billion in 2017, with modern trade expected to grow at 20-25% per annum, which is likely to boost revenue of FMCG companies. The FMCG market in India is expected to increase at a CAGR of 14.9% to reach US$ 220 billion by 2025, from US$ 110 billion in 2020. The Indian FMCG industry grew by 16% in CY21 a 9- year high, despite nationwide lockdowns, supported by consumption-led growth and value expansion from higher product prices, particularly for staples. The Indian processed food market is projected to expand to US$ 470 billion by 2025, up from US$ 263 billion in 2019-20.

FMCG giants such as Johnson & Johnson, Himalaya, Hindustan Unilever, ITC, Lakmé and other companies (that have dominated the Indian market for decades) are now competing with D2C-focused start-ups such as Mamaearth, The Moms Co., Bey Bee, Azah, Nua and Pee Safe. Market giants such as Revlon and Lotus took ~20 years to reach the Rs. 100 crore (US$ 13.4 million) revenue mark, while new-age D2C brands such as Mamaearth and Sugar took four and eight years, respectively, to achieve that milestone.

Advertising volumes on television recorded healthy growth in the July-September quarter, registering 461 million seconds of advertising, which is the highest in 2021. FMCG continued to maintain its leadership position with 29% growth in ad volumes against the same period in 2019. Even the e-commerce sector showed a healthy 26% jump over 2020.